Nasty things are brewing in the global pot

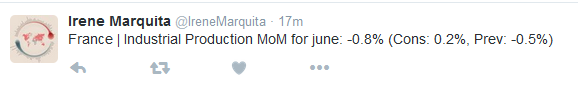

Well, you read it here first. That’s 40% worse than May, and four times worse than expected. (The month of May, not Theresa May)

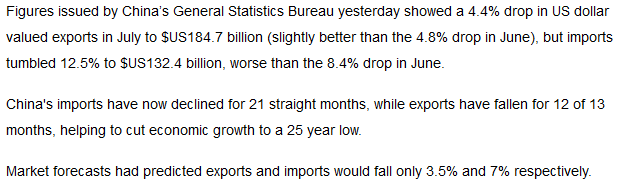

Oh dear. And just when everyone was telling us that China was in recovery. That’s 50% worse than the previous month – also worse than expected.

After flailing around all over the place – and failing in everything he’s tried – Shinzo Abe seems, finally, to have given up on Nirponomics and is returning to zeronomics. Actually, investors in the never-ending search for income took the decision for him and sold off BoJ bonds bigtime last week.

The immediate effect was a rise in eurobonds.

It’s a Big Story because its potential for contagion is infinite…..and it coincides with yet another outbreak of macho at the US Fed, following last week’s ludicrously hyped Non-farm payrolls jobs data.

So this is the outlook. France’s basketcase-weaving skills are becoming increasingly obvious, and just happen to be colliding with a slowdown in world trade.

In turn, the world’s most indebted and depressed nation is finding it more expensive to borrow money, and that just happens to be about to collide with a Fed rate rise in September…with the eurozone desperate for capital investment, but feeling the backwash of rising Japanese bond yields just as the Italian banking crisis starts to boil over.

Most people are on holiday in August. Most of them are back by the end of the first week in September.

October could be a very interesting month indeed.