Is it a Minister? Is it a company? Or is it just another rotten Crabbapple?

REVISED & UPDATED, 25.5.16

The loveliness of Stephen Crabb (the devout Christian who manages to be a Temple Moneychanger at the same time) goes on and on. The man at the helm of the DWP – who thinks 1950s born women illegally deprived of State Pensions have no case, and therefore he refrains from engaging with them in any way – was censured for his Parliamentary expenses in 2009.

The loveliness of Stephen Crabb (the devout Christian who manages to be a Temple Moneychanger at the same time) goes on and on. The man at the helm of the DWP – who thinks 1950s born women illegally deprived of State Pensions have no case, and therefore he refrains from engaging with them in any way – was censured for his Parliamentary expenses in 2009.

Now evidence has come to light suggesting Mr Crabb is reducing his tax bill via the use of company incorporation.

The search engine Zoominfo lists a company called, simply:

Crabb operates as a constituency MP from Suite 1, Winston Churchill House. His company is described as ‘active’, but the business description entered is ‘unrestricted business activities’. Right, fair enough….that clearly brings its purpose into sharp focus….nothing to see here, move along please.

The startling information above, however, shows that at todays £/$ Forex rate, Stephen Crabb the company has a turnover of £1.64 million, and employs more than 10 staff. So obviously, there must be a lot going on.

But the only problem with that conclusion is that Companies House – four years after the company’s formation – has no details at all on what Stephen Crabb [the company] does. As such. In fact, Companies House has no record of Stephen Crabb the SME at all.

I offer now some clues as to why the Company Stephen Crabb exists: tax avoidance.

Incorporation of yourself as a company allows the following:

- The payment of a small salary to oneself at the tax free level – ie, the standard Personal Allowance of £11,000, on which Stephen Crabb the company and the individual may well not have to pay tax at all.

- The payment to Stephen Crabb the company and the individual of dividends on company profits in lieu of further salary. Taxes on dividends start at 10% (half the income tax rate of 20%) with no NIC contributions to pay at all.

- Even at the higher dividend rate of 32%, a tax credit to Stephen Crabb the company and the individual of a tax credit rocks in at the notional value of 10%.

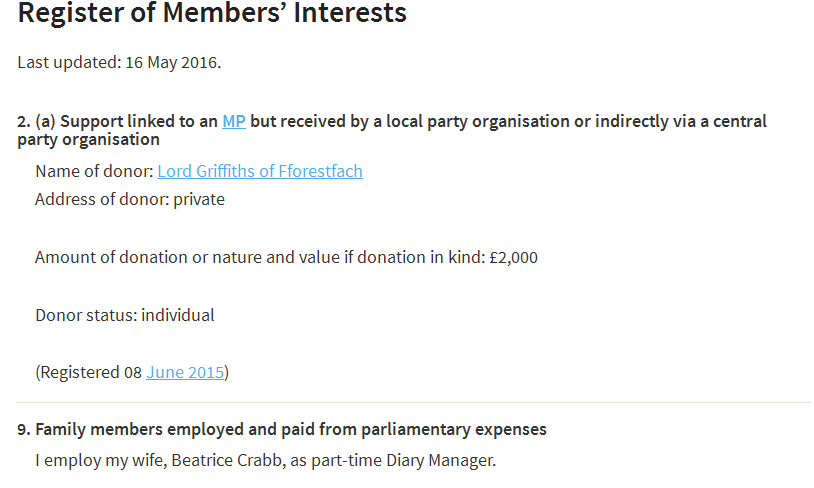

It’s all a very neat way to pay less tax – and thus cheat the State out of taxes that help to pay pensions to desitute Waspis – but there’s something missing that makes it more than just reprehensible: Stephen Crabb’s deposition to the MPs’ standards body makes no mention at all of his alter ego existence as a company:

Call me wacky, but I would describe my 100% ownership of a £1.64m company operating from my constituency surgery address as an interest. I mean, be fair – at the very least, a hobby.

Nevertheless, her indoors Beatrice is but one employee….who are the other 10+? And how do they generate that amount of income from one Minister’s salary of £135,527?

And while we’re at it, are MPs supposed to be businesses when they should be public servants?

It’s all terribly confusing for those of us less au fait than most with the mysterious workings of the UK’s HMRC. But carry on reading, because the situation gets murkier the more one looks into it.

You may have noticed that the address of Stephen Crabb – MP and ethereal trading entity – is Winston Churchill House. Mr Crabb doesn’t own the suite there, he rents it. These are his landlords:

Jonathan E Macy and Louiz CK Nielsen lead us into other unseemly areas covered previously by none other than Guido Fawkes of Order-Order Parliamentary corruption fame. They appear here under a Guido Investigation called Rent Swappers. My oh my, but that’s got a familiar ring to it.

They also turn up again under a Channel 4 investigation:

What might ‘reimbursed to MP’ mean? Does that marry with Stephen Crabb’s details as given to the Standards Committee?

Is all of this just cheap innuendo? I think not.

Before 2009 and afterwards, we can see a very clear trend in Stephen Crabb’s behaviour, and it is this: a history during which he emerges as a tax avoider taking advantage of every allowance, every tax loophole and using every legal but unethical fiddle to gain personally at the expense of the ordinary citizens he is supposed to defend. Employing his wife, for instance, makes her salary tax deductible for him, and a lower rate of tax on income for her.

Clearly, Mr Crabb is not some brainless Waspi “breezing through life without thinking”. His judgementally unChristian Christian beliefs extend to arrogantly sanctimonious judgements about everyone….except himself. I don’t care about what happens to Mr Crabb in the light of these latest allegations: he is just another pompous zealot thrust into public life by the triumph of sociopathic values.

But I do care about Waspi women being given what is rightfully theirs – without compromise or halfway houses. And they are not going to get what government after government promised them until they recognise in full the nature of those determined to make them beg and crawl for the crumbs of the crumbs from the Establishment’s obscenely overladen table.

Stephen Crabb is the Secretary of State at the Department of Work and Pensions. He is not going to engage with the WASPI campaign, and he is not going to go quietly. He must – despite all his hateful arrogance – be driven from office….for once, the patronising purveyors of disgraceful double standards should be given a clear warning that the mass financial rape of 1950s women will not be tolerated.