BUT THE WESTERN PRESS FOCUSES ON BREXIT. WHAT A JOKE

One golden rule one learns slowly -and I suspect, never quite entirely – in this lark is “never post when anger has completely taken over the brain”. Also, I’ve been busy in the garden repairing stuff after the tempests of late winter. All these were good things to be doing; commenting on pathetic Labour Opposition strategy and blasé Government responses would’ve achieved nothing.

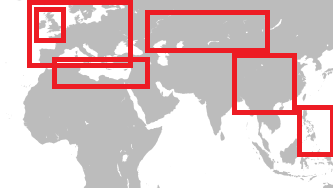

I blogged on Monday about econo-fiscal hot squares, sorry, spots around the world where even Boombust, CNN and the FT (I notice since the piece) can no longer deny the size of the problem. Things in all those places do seem – quite quickly now – to be getting worse.

¨¨¨¨¨¨¨¨

The IMF published a sensible document late Monday confirming that view. It singled out the eurozone as being one area where the lack of effective ammunition for monetarist policies was now disturbingly apparent. As is happening with central bankers increasingly now (Draghi himself, and also Mark Carney) the parcel bomb is being hastily passed back to the politicians. The IMF remarked that the political class needed to respond quickly to “the slowdown” with a collective stimulus worth of around 2% in every larger economy.

What seemed clear was that Christine LaFarge didn’t mean banker tricksies, she meant FDR-style investment projects and research in both the private and public sectors. Chrissie the Challenged Mathematician thinks such things would “quickly reverse the downturn”, but just in case anyone thought she was morphing into mixed economy economics, the former French finance minister (failed) added that this would not suffice on its own, and it would require “changes and reforms in the labour market” in order to fully boost the global economy.

And of course we all know what that means…more slavery contracts, and lower wages. I give up on neoliberals who can’t spot the join between rotten, greedy employers on the one hand, and consumers with no productivity drive or PDI on the other. In the case of Miss Suntan 1962 and Squeaky Osborne, it’s pure stupidity. In others, it’s a case of spinning things out while looking for someone/something to blame once The End approaches.

Either way, the IMF wags a finger of admonishment to tell Mario Draghi that “the persistence of low inflation and its interaction with the debt overhang is a growing concern…The ECB should continue to signal strongly its willingness to use all available instruments until its price stability objective is met”.

Here’s a banana for a gun Mario, go rob a bank. We’re depending on you.

But Draghi is the one man who fully appreciates his bum is in the poo while his mammories are pointing to the heavens. He has spotted (as have many others) that eurozone businesses and banks are risk averse (to be gentle about it) and short-term greedy (to get real about it): so too are SMEs who lack confidence in the outlook and trust in banks. Three times this week I’ve heard the phrase “about to hit the wall” in relation to the ECB’s expanded QE programme. The ECB’s balance sheet isn’t “showing” as my Mum used to say, and several pols – especially in Berlin – are lashing out about negative interest rates.

The prime reason for German nerves (apart from the neurosis endemic in German culture) is just how bad the situation in Tokyo now is. With the Yen striding backwards to 108 to the Dollar – it was meant to be at 1.30 by now – serious, heavy hitting commentators are beginning to use the insolvency word.

Former IMF chief economist Olivier Blanchard points out that NIRP has disguised the underlying danger posed by Japan’s public debt, which is far and away the biggest in the World. Patriotic Japanese personal investors remain willing to stay in Government bonds at ZIRP (as predicted by Gillian Tett five years ago, so hat-tip to her) but Blanchard notes – as have I and thousands of others – that the debt is now so humungous, foreign buyers are required.

The NIRP simply won’t hold. At that point, we could well see rates for international lenders going up rapidly…and once that happens, Abenomics is that limp bunch of feathers crashing into the lake, aka a Dead Duck.

The US and UK will have to think about about that one; the institutional US in particular may choose to go along with NipNirp – in an attempt to keep rates at a level that won’t in turn render Washington insolvent. But markets will break through. I still maintain what I first asserted in 2009: sooner or later, somebody will break rate ranks to attract money; at the minute, Japan is looking the most likely candidate.

Blanchard summed this up with euphemistic politesse when he told an audience in Lake Como, “If and when US hedge funds become the marginal Japanese debt, they are going to ask for a substantial spread”. Correct. [The audience wasn’t actually in the lake at the time dying of hypothermia. Just thought I’d clear that one up]

In my view, Japan is going to become Crash2’s 1923 Germany – banishing debt via the route of warp-drive hyperinflation. Such things are infectious.

¨¨¨¨¨¨¨¨

Monday’s Slogpost also highlighted the likelihood of the Italian can finally spilling worms all over the kitchen floor. Italian bank shares have dropped 50% in value, with €360bn in bad debts putting off all but those with the most faith in insurance company solvency. That’s nearly 20% of the Italian GDP. There is much talk of funds for this, insurers and asset managers for that, and bailins for the other.

It all sounds jolly good, but the the hot air rises from political heads, others are voting with their feet. “Barclays is starting the disposal of its portfolio of performing and non-performing loans, the last step of the bank’s exit plan from the Italian retail business,” regional CEO Alessandra Perrazzelli said last week. “We are now testing investors’ appetite.” Test away Ally, but don’t hold your breath: the sum to be disposed of is an eye-watering €57bn.

One Berenberg analyst somewhat obviously observes that the “Italian banking sector is at a pivotal moment in its history”. The bloke, Elio Mullany, adds, “We worry that a bail-in of an Italian bank may cause a chain reaction with ripple effects felt across the European banking system”. Don’t worry Elio, be certain; it lowers the anxiety levels to know that death is inevitable.

More and more analysts are in fact deeply cynical about (and critical of) Mario Draghi’s efforts to prod eurozone companies to spend on growth. Stoxx Europe major players remain happily pooing away in the woods.

More of the bleeding obvious was also apparent among those “analysing” the effects of the oil price. The current IMF Chief Economist Maurice Moses Obstfeld said it was “difficult to see prices recovering to $100 a barrel any time soon “. Maury’s use of the word “difficult” there represents an all-time great of understatement so profound as to be worthy of a new description to replace that collective noun. Something like ‘bottomsure’ might nail it.

Meanwhile, in oil exporting countries like Saudi Arabia, Nigeria and Russia, households, businesses and governments must all cut spending to cling on in there….which means even less consumption, and further deceleration of growth. Recession, actually.

¨¨¨¨¨¨¨¨

When we have slowdowns and deceleration and oil gluts and look, sod all these prissy fudges…it’s a recession actually….gold is always a winner. The shiny metal represented another topic at The Slog last Monday, and the lack of belief in fiat currencies is now so widespread, I’m more convinced than ever that the gold price must start to break out soon.

An early sign of this is what one might call the ‘gold backed’ or ‘firm promise’ sector of tracking the gold price: not a straightforward purchase of bullion or a simple paper contract, but buying into an exchange where the investor becomes a creditor to be paid in gold. In practice, of course, that never happens: the reassurance is enough. Normally.

But these are interesting times, not normal ones. Goldbug David Jensen writes an excellent piece here about the London version, noting that the daily gross turnover of gold trading on the LBMA spot market is 200 million ounces…which is, um, twice the world’s annual gold mine production. Or put another way, a bubble.

Jensen foresees an LBMA “gold event”, and he’s right. Actually owning the real thing is now by far the best option….but even that is not without the risk of legislators starting to panic about private gold sales.

¨¨¨¨¨¨¨¨

So all in all, it’s not looking good. The Yen is sort of taking a deflationary run-up ready to fire the next pitch into hyperinflation, so gold could become another virtual bubble fuelled by digital fantasy.

Nobody believes in the Italian banking sector any more, and few now expect a Draghi Qenirp to change behaviour in the intended manner across the eurozone. The IMF says “political action or else” but as usual the political class is engaged in blamestorming and squabbling.

Beyond the various bubbles, however, reality is intervening. The corporate earnings expectation across all US sectors for the first quarter of 2016 is around 10% down. This will be heavily biased towards collapsing bank results – but don’t lose sight of worldwide pc shipments declining for the sixth consecutive quarter in a row – an outcome not seen since 2007.

Zacks research reports bluntly, ‘ the Q1 earnings picture looks bleak with projected earnings growth deep in the negative territory for the fourth consecutive quarter. In fact, the magnitude of negative revisions over the last three months has been the highest among the recent quarters.’

I’m sure you’ve spotted that last syndrome as well.

Stay real. Brexit is, at worst, a potential trouble spot: China, Japan, Italy and the eurozone are too big to bail.