The Slog interrogates Negative Interest Rates Policy, and concludes it is the most culturally destructive idea yet devised in this, the eight-year vain attempt to save financialised global monetarism from itself.

Bank of England governor Mark Carney rarely gets animated about anything (he knows that just one frown could collapse the Pound) but he suddenly had an attack of vehemence at the last MPC press conference. Asked by one hack whether the committee had discussed a negative interest rate policy, Carney snapped, “No…the bank has no intention of, and no interest in, instituting such a policy”.

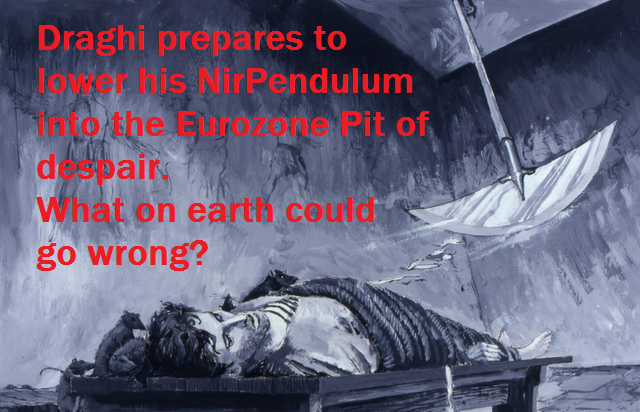

Answers don’t come much straighter than that one, because privately Carney has strong views against getting involved in a race to the bottom. But the fact is, more than likely, ECB boss Mario Draghi is going to plunge his pendulum deeper into the eurozone pit in two days time.

And yet, and yet….only last Christmas, Capital Economics had this to say:

‘Given the dubious benefits and possible costs of cutting deposit rates below zero, we still see ECB interest rates remaining on hold for the foreseeable future.’

Well, two month on, the unforeseen future is here. Nirp isn’t new-new: Denmark’s Nationalbank introduced it in July 2012 and the European Central Bank, the Swiss National Bank, Sweden’s Riksbank followed suit. But it was the shock decision of the Bank of Japan to adopt it that put Negative interest rates on the map.

The idea of negative interest rates is reasonable on paper: that they will encourage investment in business, and encourage consumers to buy its output on credit, because credit has never been cheaper. But as with most monetarist ‘solutions’, Nirp fails to grasp either business psychology or the vital consumer confidence factor…as indeed did QE. Consumption is down because almost everyone is, variously, worried sick about job security, unconvinced by 35 false starts to ‘the recovery’, or impoverished by three decades of gradual wage destruction.

So of course, it won’t work. But what of the collateral damage it might inflict while it’s busy getting nowhere?

One of the best sources for rookie investors and financial commentators is Investopaedia. This is what it has to say about Nirp:

‘While seemingly inconceivable, there may be times when central banks run out of policy options to stimulate the economy and turn to the desperate measure of negative interest rates.’

‘BoJ reserves will climb as the central bank creates electronic ledgers to buy bonds from banks:

- Banks will receive newly created electronic money by selling those bonds to the central bank

- These proceeds will then become bank reserves

- These new bank reserves will then fall under the negative interest rate tier’

“Simples!” said Signor Ponzi.

* What happens if apparently strong safe havens – especially the US, but also in Britain under Carney – see huge capital inflows towards what is clearly a better deal? Both the Buck and the Quid will strengthen…a much bigger problem for the BoE than the Fed. We may get dragged into the pit…which is one reason why the Swiss had to adopt Nirp.

* When every major Sovereign on the planet has adopted the madness, what then?

This new scam scheme is no different to all to the preceding zero-sum idiocies foisted upon real economies by the monetaristas and their globalist chums since 2008. It won’t work, but it will be dangerous.

So we’ll do that, then.