Well we got trouble, right here in Money City….with a capital T and that rhymes with D and that spells Debt

Borrowing is just useful leverage when the sun shines. But when it rains, borrowers in all the sizes and colours – from the local authority via the margin-caller through to Sovereigns and corporate share purchasers – are in debt. The planet is replete with unsustainable borrowing, and the growth to repay it just isn’t there.

When the Shanghai only loses 0.1%, it’s a subject for celebration these days. But don’t be misled. This is what actually happened on China’s main exchange overnight: in the first session, the Shanghai dropped 30 points…after which (as usual) everyone broke for lunch while the PBOC flogged off some more bonds, and amazingly, at the pm opening all the losses were regained. And then lost again. And then regained.

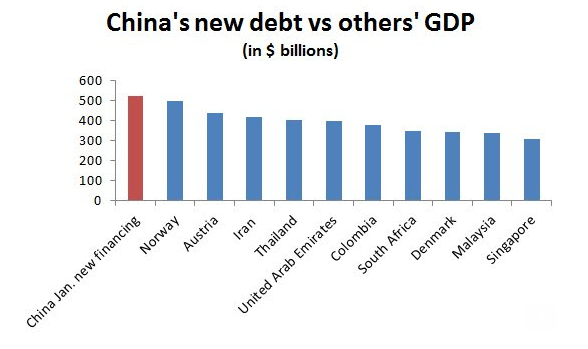

Take a look at this UBS graph of the debt run up supporting the Shanghai during January this year. It is compared below to the annual gdp of some other countries:

China spent more propping up one bit of its service economy – you know, the one that’s going to save it one day – in 8% of the year than the entire economic output of each of the other variously oil rich and growing economies alongside it there.

This not only backs up Nöel Coward’s assertion that China is “very big”: it highlights why Larry Summers and many other intelligent commonsensicals say this support is “unsustainable”. It’s surreal.

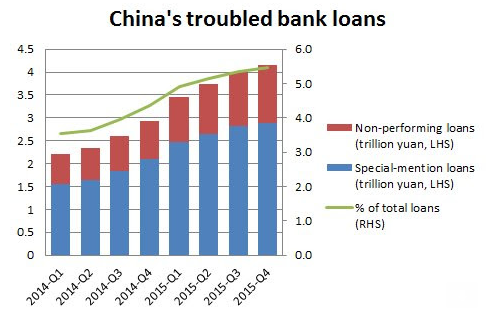

The country is also in the grip of a runaway credit boom in the institutional sector. The problem has always been local government indebtedness, and once again it has shot up. Much of it has been bought by the country’s banks, as this equally alarming chart shows all too clearly:

Over the last two years, Chinese unrecoverable debt has risen 115%.

Corruption is endemic in China, and every bent dealer and bankers is trying to bend every rule in order to buy gold and get their money out and into another currency. Yesterday, Spanish police and Europol arrested five directors of Chinese bank ICBC following a money laundering investigation. Police sources allege the gang were trying to move as much as €40m into the eurozone financial system. These signs do not suggest a cultural economy in good shape.

The situation is the same in the US – fathoms of debt – but a lot of this is senior multinational executives using cheap Zirp and QE money to buy back shares while the market has been going backwards. Sadly, the recovery hasn’t happened to enable paying off the loans, and so now they’ve become the banks’ new sub-prime borrowers.

The US élite insists of course that I’m talking twaddle and the payroll numbers prove it. But employee numbers prove nothing: the only thing that talks in the US is the Munnneeee. And things are dire in Money City: In Q4 2015, corporate earnings declined 4% at the largest 500 publicly-traded companies – the steepest slump since 2009, according to Bank of America Merrill Lynch research. Sales at the 500 S&P quoted companies fell an average of 2.5% on the year as a whole.

All this debt, all this hope. See that wing, hear those prayers.

And in case you hadn’t noticed, Japan, the eurozone, and the UK are all in the same place.