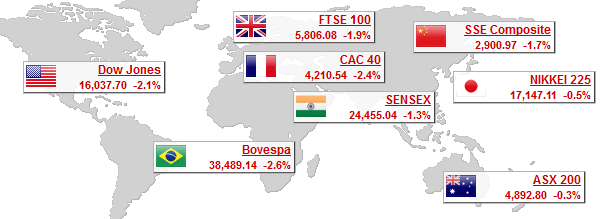

A world in the Red

As the morning progressed, the futures weren’t looking bright….they weren’t even looking Orange: they were blood red across almost all US markets. During the CET morning, they dipped from -1.3% via -2.0% to -2.7% as the markets opened. At the opening (14.30 GMT), NYSE stocks plunged.

There are various speeds in the bourse narrative space going forward, even when things are going backwards. There is fell, dipped, dropped, plunged and collapsed. ‘Plunged’ is one of the bigger descriptors. Within five minutes of the NYSE bell, the Nasdaq plunged 3% to its lowest level since Autumn 2014. Within ten minutes, the Dow plunged 400 points. As I write, it is 37 points above the dreaded 16,000.

I spent a fair amount of the middle of my day (after levelling the soil over a septic tank) watching talking heads across the world debating WTF was going on, but during that time there was little or no mention of the following facts:

* The Baltic Dry Index is now 50% below Great Recession levels

* The Bloomberg Commodity Index now at its lowest point since 1991

* The US rail cargo idex is halfway round the toilet S-Bend heading for the sewers

* US Credit use is falling because there’s no consumer confidence out there, and plastic cards are maxed out

* US industrial output in December fell by twice the expected number

* As investors dash towards safe Sovereign bonds and those sovereign yields fall, theDollar continues to strengthen. This produces two effects: cheaper imports into the US raising the deficit acceleration further still; and Bric Dollar denominated Sovereign debt becoming even more expensive than it was after the idiotic Fed rates rise.

There’s a long weekend coming up in the US. We’ll see whether it calms people down….or simply gives them time to consider that maybe we need to get this thing over with.

Either way, as I wrote earlier, this is not a dip, it’s a plunge that will be a correction come what may.