Quietly circling the eye of the storm, he knows there will be tears before bedtime

The bigga-wiggas lived upon a mountain top

They walked around in circles because they dared not stop

I cannot believe I am the only one to have noticed an uncanny silence in the world of global finance and economics.”I don’t like it, it’s too quiet” was one the of great Clichés of Hollywood Westerns half a century ago, but it is exactly how I feel at the moment. The Maily Torygraph has turned up the boom-bumper-Britain-leads volume, which in and of itself is a sure sign that we are in the poo and en route to the quicksand. Very few serious titles or websites are, however, talking about turning corners and ‘powering up for the recovery’. To be sure, the US is in real growth technically, but not a single source or columnist I trust finds the data either compelling or convincing.

In that context, people are smiling a great deal and using whatever palliative is to hand as a means of ignoring the inevitable. Summarise

The donning of voluntary blindfolds

US new house sales plummmeted by 11.53% in September. But the top end, Glitz-brick property prices roared along on there way to the stratosphere. People in the middle have no cash, people at the top are getting out of cash.

Those at the top have pulled so much cash out of the markets, Hedgies lost up to 11% off their collective asset bases in 2015’s Q3, wiping $727.7bn off the totals under investment. Black Rock alone lost $215bn during the three months to the end of September. As you might imagine, my clothing is damp with tears.

But the strain on asset managers, as bets go the wrong way, must become unbearable before too long. Some of the losses are obviously being borne by the Fed (see Spikes of late) but falling demand – as the fundamentals finally make their comeback – means a price war on fees as investors struggle to screw every last cent out of a Zirped environment.

On this somewhat sticky wicket, the French economy is doing worse than most. But the yield on French 2-year bonds has been negative since September 2014. The fundamentals will return to that sector in due course. In the meantime, the make-believe requires more than blindfolds: virtual glasses mounted on hoods would be nearer the mark.

Those in the Evans-Pritchard and O’Neill eye-patch assembly, meanwhile, continue to lal-lal-la to loud trumps as they walk around the Beijing elephant in the Hall, but Nellie is demanding more and more attention as time goes on.

Chinese rail freight volume is not so much going trump-trump as slump-slump: it is down a further 12% this year, and under half what it was four years ago. But here too, reality is now seeping upwards from the ground and into the cloud cuckoo land of the Shanghai composite: last Sunday, Reuters wrote about how ‘Mounting bad loans are running down Chinese banks’ capital buffers, forcing them to turn to investors for fresh funds despite raising a record amount last year. Commercial banks are issuing expensive preference shares as well as convertible and perpetual bonds to shore up their capital bases, but with bad loans up 30% in the first half of 2015, doubts are growing about the ability of some banks to withstand the economic slowdown.’

Yes, it’s that old ‘borrow money to pay debts solution, a sure-fire winner every time.

“China is facing a systemic credit crisis,” says Jim Antos, banking analyst at Mizuho Securities in Hong Kong. No sh*t Sherlock.

Liberal use of recreational powders

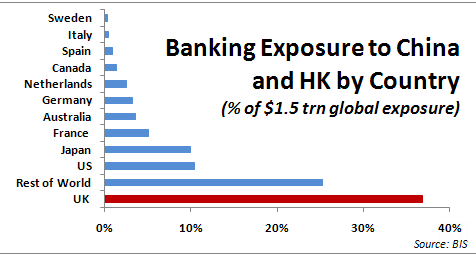

Take a look at the UK’s exposure to the crumbling Great Chinese Wall:

Not such a great outlook for Osborne & Brittle Crackcover Decorators of Westminster. More woe for the Septic Isle as GDP missed its target, and more evidence of how hopelessly unbalanced our economy is. The emergence of a recession in manufacturing and the biggest slump in construction output since 2012 was at the heart of it: the latest ONS data put a cruel spotlight on Britain’s daft paper economy, growth this time being 100% due to more growth in financial and techie service sector.

Real manufacturing industry has now been heading south for three successive quarters. So much for a March of the Makers as predicted by the ‘Chancellor’ recently. The bloke is clueless: his downfall is at the end of the beginning; I said last year that Ossie the Prince of Darkness was in a race between the data and the election. Well, he pulled that one off….but only just.

In such trying circumstances, a chap needs more than a blindfold: one needs something to dull the smell of burning too. Thank goodness then for South American nasal irrigation.

Everything Normal Jargonised Distraction

If anyone can translate the following technodrivel, then please write to the usual email address:

I can think of quite a few economic policies I’d like to proactively remediate on the subject of false positives, and several jargonistas I’d like to throttle with the same degree of subtlety they use to strangulate blind spots.

Even rogue adolescents who go on killing sprees can be normal and distracting, it seems. Hat-tip to Taylor & Francis for sending me this:

‘Danzell and Montanez’s ‘Internal Pack Conflicts Theory’ suggests that lone wolves are often the result of multiple key personality and environmental drivers….While previous typologies provide important insights into lone wolf terrorism, the current literature often overlooks an important intervening variable…They fail to sufficiently enlighten the intelligence community and law enforcement officials on the process that explains the ‘turning point’ in the lives of lone wolves…….Even though lone wolves thrive in isolation and engage in minimal interactions with others, it is within these social interaction processes (or lack thereof) where lone wolf motives, intentions, and behaviors ignite….’

Well, yes – that and letting them buy guns and ammunition from anywhere without a licence.

I have listened respectfully over the decades to many Americans telling me the Right to Bear Arms is essential, because it means an armed citizenry capable of taking on a dictatorial élite. In practice, it seems to me to have produced two thing only: lots of dead bodies, and a police force armed to the point of military power. Violence breeds violence. It always has and it always will.

At The Weekend Slog: The vain search for competence continues