MARKETS WITH NO REFLECTION, PURCHASE-FREE RECOVERIES, NUTS IN BRAZIL & DIABOLICAL DEBTS IN BRITAIN

MARKETS WITH NO REFLECTION, PURCHASE-FREE RECOVERIES, NUTS IN BRAZIL & DIABOLICAL DEBTS IN BRITAIN

(It is the work of the Devil, I tell you)

There are three numbers at the moment no trader wants to see the bourses go below: 16k (the Dow) 6k (the FTSE) and 3K (the Shanghai composite). Slowly, exhaustingly but inexorably they’ve been dropping towards 150 or so points of those ‘psychological’ levels. 16 + 6 + 3 = 25.

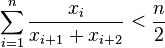

According to the Shapiro Inequality, 25 is the least odd integer n such that there exist  such that

such that

where  .

.

Sixties pop singer Helen Shapiro had her first hit when she was sixteen. She had six hits in all. She has three children. That equals 25 as well. OMG. What’s more, in Ezekiel’s vision of a new temple, the number 25 is of cardinal importance in Ezekiel’s Temple Vision (in the Bible, Ezekiel chapters 40-48). Ooowerr.

There’s more still: 25 is the smallest square that is also a sum of two (non-zero) squares, 5×5. This can only mean one thing….it’s a zero-sum game, and Ezekial’s circle is about to be squared by a factor of 5: all stock markets will drop by 80%.

You read it here first.

You might as well follow that sort of Knights Templar thinking, because none of the markets reflect anything: that’s right – they have no reflection in the mirror. They are the agents of Lord Beelzebub, and only a gross of font-water soaked crucifixes can turn them to dust. Well, that and events.

The only equation you need to solve is this: how long can manipulation stay sentiment before panic turns correction into catastrophe? As nobody has the answer to that one (least of all Janet Yellen, the Beijing politburo, George Osborne or Mario Draghi) the smart move as of two weeks ago was GTF out.

But if you’re still banking on normality being round that infinite corner where the shoots turn green and you can fly to the sun at night when it’s cooler, here are some further symptoms of terminal cancer to observe….

S&P issued this press release yesterday:

Another bric hits the wall, as one might perhaps say….but an imminent disaster predicted by all sane economists the minute Yellen began tapering QE.

However, as Jim O’Neill’s hyped brics sink like, um, bricks, we still have what’s being dubbed The Second Eleven as chosen by those upstanding, multiple class-action facing Masters at Goldman Sachs. The 11 include places (like the Philippines, Turkey and Mexico) that saw share booms as foreign investors washed their markets with fiat paper. Inflows into Goldman Sachs’s U.S.-domiciled Next 11 equity fund sent assets under management to twice the level of the firm’s Brics counterpart.

Today, the 2nd XI look as if they’re about to retire hurt from the game: their composite equity gauge has collapsed some 20% – even worse than the 14% Bric index plunge. The Goldman Sachs fund has shrunk by 50%. Perhaps they should rebrand as Foldman Cracks. Still, nihil desperandum Lloyd – bonuses all round, Yo!

As many of you know, the one thing that has both saved Greece from Communism and restored the EU to health is Finland – that small plucky country which spewed forth the opinion millionaire Alexander Stubb, one of the few men in the world Wolfie Schäuble likes to pull out his tongue at.

But Alex has been found out: for Finland is emerging as the European Union’s weakest economy because of its failure to build a competitive labour market. Its economy is contracting for a fourth consecutive year; Stubb described the development as “worrying.”

The government has so far failed to persuade Finns to accept pay cuts that Alex happily shoved down the Greeks’ throats, and the country’s problems have been exacerbated by Russia’s recession….which in turn exists thanks to US and EU sanctions…in which Stubbsie was an enthusiastic catalyst.

What can one say except hahahahahahahahahaphuuuurt?

Many people may have missed it, but the news yesterday that Waitrose profits had halved, while Morrisons’ earnings were negligible (and they’re about to close 12 stores) came on the back of what UK citizens already knew about the struggles of Tesco to keep afloat. The deep-discount supermarkets are gaining share hand over fist and giving the lie yet again to any credible idea of a real UK recovery. We have had the jobless recovery and the less hours recovery, but now we do seem to be staring at the purchaseless recovery.

Or – put another way – there is no recovery.

One in eight households in the UK now have ‘problem debt’ – that is, they spend around 25% of monthly income on unsecured debt repayments, such as credit cards, loans and overdrafts. But 1.6m households are spending as much as 40% of gross income on debt repayments (not including housing debts like mortgage or rent payments). And a huge majority – 1.1m – are lower-income households. They are thus forced to trade down while at the same time juggling one debt against another.

No mass-market recovery in British gdp is possible while the masses themselves have neither the cash nor the confidence to consume….and exactly the same Page One rule applies to downmarket US and European mainland families.

Equally, as long as short hours, zero-security and zero-benefits employment models predominate, there will be no improvement in productivity. Who in their right mind expects underpaid and demotivated workers to reward serial disloyalty on the part of their employers with increased productivity?

Amateur Friedmanite disciples seem unable to understand why absent spending and falling output per head are obvious results of the neoliberal claptrap we’ve been fed for nearly two decades. This concerns me greatly, because I’ve always slept better when I felt those ‘above’ me knew WTF they were doing. As they obviously don’t – but continue to pontificate upon the absence of viable alternatives – I get sleepless just thinking of the parallels: such as, I feel day in day out as if nuns are categorically insisting that only indulgence in depraved sex can save the human race. The obvious response is, “What on Earth would you know about it?

Some time soon (and at long last, we are talking ‘soon’) the bollocks hiding behind the pies in the western Sky will drop to earth with a squelch, until enough analysts realise that financialised capitalist make-believe is transmuting as rain upon the real world below. That means cash flow crises, price wars, further deflation, major distributor failures, rising unemployment among even the underemployed, and catastrophe for those banks facing bad debts, failed loans and bad bets as the chickens come home to roost.

So when you look out of the window, and wet roosting chickens are dodging falling bollocks while trying to catch plummeting pies, then you need only the warbling obese woman for the full set.

Just as one wouldn’t give an ice-cream vendor the job of kitting out a probe bound for Venus, so too we shouldn’t elect 650 people who know nothing about social anthropology, and from them choose a draper’s depraved son to run the economy….alongside the spawn of an offshore tax evader to put the bankers’ house in order and protect the citizens. We like generalists in Britain, because you see otherwise we’d get nasty corporate technocrats running things like they have in Brussels. Here in Blighty, we vote for gophers who take the orders of technocrats, because we are the fount of modern democracy.

Neolibrics, Neolibritain, Neolinland, Neolichina, Neolibeuro, Neolibereleven. It’s all going so terribly well, isn’t it?

Enjoy the weekend.

Yesterday at The Slog: Why is Britain turning into 1933 south side Chicago?