WHEN MARKETS FOLD, IT’S TIME FOR GOLD

WHEN MARKETS FOLD, IT’S TIME FOR GOLD

The Slog argues that gold shows signs of reverting to type.

The only difference between the Chinese stock markets in at the moment and the US markets from 2010-14 is that the PBOC is directly buying stock nobody wants, whereas under US QE, the Fed hoovered up unwanted junk the banks wanted to offload. The US approach (alongside Zirp) also gave easy non-production profits to multinations unable to sell their wares.

Both are an obvious scam of manipulation, but for some months now, Fed Chair Janet Yellen has been promising Quantitative Tightening, with Vice Chairman Fischer trowelling on more false confidence at Jackson Hole. I think of this spin as Quantitative Teasing, and although geopolitically this might wind up the Beijing Politburo, very soon now the tease will have to stop: we have approximately three weeks before that moment of truth fails to deliver. And whether the delivery promise is fudged or not, there will then be at least some degree of realisation among investors that this has been more a moment of mendacity than truth.

I do not doubt, by the way, that directionalisers will pump out gallons of BS about the need to pile into the markets now that, after the rate rise ‘to come’, stock valuations must rise in the wake of such a Golden New Dawn. I think it very likely that there will be a brief pre-FOMC Bull run, and it’s even quite possible that a token 0.25% rate rise might emanate from the Fed to support this ridiculous notion. The only snag being that stock valuations are already way too high.

Whatever Yellen does later this month, it will be wrong. A big rates rise could temporarily boost the markets, but then be reversed when profits start to fall….or completely freak Wall Street out – while perhaps stopping housing activity dead. A tiny one will be seen as ho-hum, convincing more and more players that the Fed is bluffing – which it is. And bottling out of the rise will start a sell-off on the basis of OMG the silly tart’s all over the place.

In the meantime, the external news can’t be ignored or blacked out….yet. Day 5 of the the PBOC’s Quantitative Buying (QB) is running exactly to the itinerary predicted here earlier this week: smaller daily market falls, but still net falls every single day. Beijing is pumping water on a water-resistant fire out there.

The growing realisation that China is heading towards screeching brakes and a hard landing, exacerbated by further eurozone problems, will only too obviously clarify that the World is in a debt swamp and an economic slump.

The Chinese will, I suspect, find that there is no point in making stuff when real demand is close to zero. Markets will be neurotic at best, faith in debt bonds will evaporate, and most commodities will plummet. Oil refinery output will drop. Oil will plunge.

And so now just might be the time to take a punt on the Last Resort: gold.

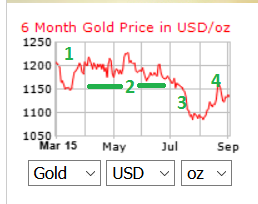

Events have spiked the wheels of gold price destruction. Those in the central banking élite who envisaged a gentle programme of discouragement and manipulation have been given an entirely predictable shock. Over the last two days, the shiny stuff has lost $12 as things seemed to be ‘fixed’ in the markets. But in the previous 30 days it gained 4%. This year the price-destruction programme took 10.3% off the value (almost twice the 5-year’s drop) but on the six month chart the voyage looks to have been blown off course:

In March, the steady decline (1) continues, but then bad euronews and a Greek debt marathon (2) sees a slight price recovery, followed by a classic events-reaction line of goldbugs reacting to events. At point (3) eurogroupe victory is in sight, but gold drops below the line it was holding in March…suggesting manipulated overselling to me. But then China markets plunge and at (4) the line moves back to where it was. That equates net to roughly five months of zero destruction – suggestive of sentiment outgunning the ‘plan’ to make gold affordable for bank balance sheet

In March, the steady decline (1) continues, but then bad euronews and a Greek debt marathon (2) sees a slight price recovery, followed by a classic events-reaction line of goldbugs reacting to events. At point (3) eurogroupe victory is in sight, but gold drops below the line it was holding in March…suggesting manipulated overselling to me. But then China markets plunge and at (4) the line moves back to where it was. That equates net to roughly five months of zero destruction – suggestive of sentiment outgunning the ‘plan’ to make gold affordable for bank balance sheet fiddling reconstruction.

This changes the rules I have applied to myself for nearly three years on gold now. I no longer think TPTB will be able to get gold anywhere near the 850-900 level that I saw as a buy signal. The simple reason for this is evidence (at last) of gold starting to react rather than detract. Alongside other commodities, it is gradually returning to normal behaviour. And ultimately, mass sentiment should always outgun manipulation.

In the real world beyond bent paper, Western and Indian consumer demand was strong in Q2 2015 (in Europe it’s up 14%) so as always the ‘market’ haha price of gold is completely counter-intuitive to what’s happening outside the bubble. Again, the surge in Europe is to do with Greece in particular and the outlook in general: more evidence of gold returning to its traditional safe-haven role.

I’m in watch and wait mode along the following lines; what you do is your business, and this isn’t advice because I’m not qualified to give it. I shall:

- Watch gold over the next two weeks until just before the FOMC, and be greatly encouraged it it is oversold

- Buy at anywhere between $1000-1075 – in bullion, not paper

- Hold for at least a week while the Fed, the stock markets and the Brics run around like headless chickens

- Hold for longer, buy more if the price tops $1250.

That’s as long as any plan can be in today’s investment climate. Onwards and, er, upwards or downwards – whoTF really knows any more?

Yesterday at The Slog: Roll away the Stone as Ginger Minge-Wader rises from the Dead.