Texas crude oil was bobbling up up and down like a mumbling volcano between $41.98 and $42.03 yesterday, but there are plenty of sharp minds out there who think there is worse to come. For around seven months now – ever since Jeff Gundlach’s horror-warning of last December – the prevailing view has been that oil at $40 or less would be catastrophic.

“I hope it does not go to $40,” Gundlach said in a presentation, “because then something is very, very wrong with the world, not just the economy. The geopolitical consequences could be terrifying”.

Oil had made a kind of recovery (partly manipulated I suspect, once the US realised it had over-egged the anti-Putin pudding) but this week it’s slumped back 7 points. As always, in a world of financial commerce where half-truths are about as good as it gets, 0.3% know what’s going on, 2.7% hope they know, 5% think they know, and 92% don’t care because the laptop has frozen and the freezer’s defrosting.

What Gundlach’s referring to is the dependence of the US on oil revenues and petrodollar charges.The size of American debt involves scooters stretching from here to Pluto and back so I won’t even go there: suffice to say that only Zirp has stopped the world’s most powerful State from needing a garage sale to flog off its nuclear arsenal.

Everything is thus on a knife edge, and beneath the edge there’s no known net that can stop the fall into a feeding frenzy of things that make sharks look vegetarian by comparison. But if I can try manfully to avoid being simplistic, I’d say that two main roosters are about to declare the dawn of something Very Different….and then engage in the Cock Fight of the Century.

The first of these is the economic operating system that’s currently the default choice of lunatics everywhere. And the second is the innately costly and inanely pointless growth of what most people now call the Shadow Banking System.

In one Sun bordering on Telegraph sentence, neliberal econonics needs flush consumers and easy credit, but itself creates the opposite; and such credit as should be available is busy going into the interbank paper-trade…destroying fiat currency and storing up sovereign liabilities. As Bank of England governor Mervyn King remarked in 2009, “you wouldn’t start from here”.

The greed of the top 2.5% has ensured the collapse of mass Western wage values in the 21st century, and the madness of the Shadow Banking 0.3% has cut off their access to credit. Falling in line with His Master’s Voice, the political class has, in turn, reduced the State benefits of all those buying 500 pairs of Shanghai socks for 50p in order that it might bail out the very banks who screwed up in the first place.

Now, however, things are returning to normal….but not in a way you’d like. My context for ‘normal’ here is the long-awaited re-establishment of real, economic, physical fundamentals.

These can, for once, be easily stated: without consumption money there can be no demand, and without demand there can be no recovery. What happens first is that the raw materials required for production and exports collapse in price…. and with nowhere to go in the absence of investment rates, those serving investment clients rush to the safe havens, whatever they might seem to be at any point in time.

Oil is just one (albeit geopolitically loaded) example of a broad trend. The following charts show other key base materials – copper and lumber – doing the same alongside crude:

In the first dive shown by this last graph, I think we see the Sorcerer’s Apprentice tinkering when he knows not WTF he is about; in the second, I see a natural deflationary indicator.

In the first dive shown by this last graph, I think we see the Sorcerer’s Apprentice tinkering when he knows not WTF he is about; in the second, I see a natural deflationary indicator.

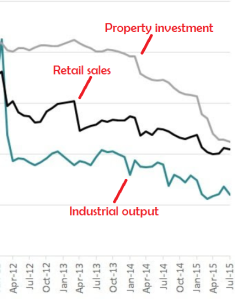

What happens next is that all those countries dependent on manufactured and energy exports (Jim’s BRICS) catch a cold. The biggest of these by a nebular light-year is China:

Beijing has tried to switch to satisfying domestic retail demand. That failed. It tried to persuade investors to pile into property. That bubbled, and failed. Then it took a crack at QE as a stimulation form. That as always pleased the banks and stock markets, but failed. So latterly, the octogenarians went for the share-owning Thatcher drivel. That bubbled, and then produced the Shanghai Chute.

So if all else fails, devalue the currency and get those exports ticking up again. And that’s what the politburo did earlier this week. By the end of the week, they’d done it three times;

The only downsides to this are first, it’s habit forming; second, it evokes retaliation from other tigers; third, if people have no money for socks, they have no money for socks – price cuts are irrelevant; and last but not least, Japan invades.

And of course, while this is going on the US Dollar is being strengthened by the Flight to Safety. I have something of a problem with investing in the currency of the world’s most indebted nation, but hey – these are interesting times. The steady strengthening of the $US is plain for all to see:

Trade-weighted or priced, the picture’s the same: imported goods being devalued, but the vast majority of the population still either under the cosh of devalued real wages….or unemployed. I posted earlier this week on US unemployment, and you can judge for yourselves whether my figure of a real 23% rate is valid or not. The point is, the US élite seems to be sitting pretty for the time being: rich in natural resources itself, and with far more lucrative ways to stay stable than an export boom (the petrodollar, inventing funny munny, killing other people’s economies etc etc) the State there can pull in trillions of dollars by appearing to be not just any port in a storm, but effectively the last helicopter out of Saigon.

Trade-weighted or priced, the picture’s the same: imported goods being devalued, but the vast majority of the population still either under the cosh of devalued real wages….or unemployed. I posted earlier this week on US unemployment, and you can judge for yourselves whether my figure of a real 23% rate is valid or not. The point is, the US élite seems to be sitting pretty for the time being: rich in natural resources itself, and with far more lucrative ways to stay stable than an export boom (the petrodollar, inventing funny munny, killing other people’s economies etc etc) the State there can pull in trillions of dollars by appearing to be not just any port in a storm, but effectively the last helicopter out of Saigon.

Against Korean, Singaporean, Indonesian, Australian and South African currencies, the Dollar keeps on rising. In turn that means raw materials needed by American big business get cheaper and cheaper…so even if they don’t export them, US-made goods get cheaper domestically….and so the budget deficit must, in theory, decline.

But the debt is still there in the background….getting in real terms bigger as the Dollar strengthens. And a collapsed oil price reduces that enormous income the US makes every day from controlling the commodity trades in it.

And now three devaluations in a week from the Chinese means that most of the American debt just got even bigger.

What we’re seeing here, I think, is Asian deflation leaking onto the highly unstable rods powering the US economy. After too much of that for too long, the assumptions of safety are blown away, and one is faced with the prospect of an econo-fiscal Chernobyl.

A global slump involving unstable dictatorships all over the place is bad enough. But it’s the second cock in the pit that will add an exponential dimension to the slump, turning it into a financial collapse of almost unimaginable proportions.

To explain why, I need to stick for a while with my avian analogy. Time was – not that long ago – when cock entrepreneur went to mother hen bank for a loan to help expand the business. Thus, although personal banking was a form of usury that involved the staff always saying “No”, the bank laid so many golden eggs by taking personal salaries and then charging us for the privilege that, outside of the inevitable boom-bust credit squeezes, there was money available to help leverage small to medium sized businesses. The better the business did, the better the bank did, and so cock and mother hen were on the same side. Even more important, the two were dependent on each other.

But then a number of things happened in very short order. In 1970 came the credit card, removing forever the stigma of old style ‘hire purchase’ loans. Soon afterwards the retail banks began to close local branches and centralise decisions. This cut staff costs and also the very high risks involved in moving large sums of cash around. The first electronic cash machines appeared not long afterwards, and EFTPOS (electronic funds transfer at the point of sale) within a decade after that. The Conservative government of 1979 soon began to introduce sweeping personal tax cuts, and the consequent surpluses in current accounts increased pressure on the retail banks to offer free charges plus interest on non-business deposits.

Bank branches got bigger and bigger, consumer spending went higher and higher; and then in the mid Eighties came bigger privatisations (offering quick profits to ordinary citizens) and Big Bang: a massive deregulation of City banking and a major switch away from retail to investment banking – but, very importantly, no accountancy walls between the two.

There were walls however between retail staff (most of whom were either bemused or fired) and the dealmakers. These latter were the new cocks, although far too often the description was more apt in the context of human anatomy rather avian gender. While the going was good on mergers and acquisitions, and the globalist ethic stomped ever onwards, Wall Street and City ‘banking firms’ were still connected to business – albeit stifling most entrepreneurs and small retailers in the process – and now for the first time, merchant banks became active and aggressive suppliers of M&A and leveraging ideas for new ideas and products.

The Crash of 1989 slowed a lot of that sector down, and so now non-retail banking turned its attention to interbank trading, and supplying investment ideas (often involving commodity futures) to the super-rich already created by the first ten years of neoliberalism. By 2003 this had created a derivatives bubble and banks whose entire businesses – including retail – had very high risk asset to income/capital ratios. Several distinguished financial commentators pointed out at the time that this was both mad and, in terms of manufacturing-based renewable capitalism, dysfunctional.

Sadly, the US Fed Chairman Alan Greenspan didn’t take any notice, and five years later we got the Credit Crunch – and a worldwide bailout of banking firms by sovereigns from New York to Nagasaki. But even after this, the Shadow Bankers (who were by now very much running the show) weren’t interested in banking reform, because they weren’t interested in business, citizens, trickling wealth or indeed anything except their élite clients. It has been estimated recently that this client base is at most 200,000 – that’s 0.003% of the planet’s population – and that the Shadow Banking sector has grown five-fold since 2009. As a measure of how useful it is, the dreaded Shadow has taken China from being the world’s largest creditor nation to being a net debtor in six years.

And so we arrive back at China. Industrial Cock of the Walk still, but slowing down rapidly and not the impregnable entity it seemed in 2010. It is – along with its fellow Bricocks – seeing its growth stunted by demand falling off a cliff: a direct result of neoliberal policies and expectations.

Before too long, the EM Industrial Cock is going to be in the pit against the West’s Shadow Banking Cock in a fight to the death. What on Earth could go wrong?

The problem is that a deadly combo of Sovereign manipulation, mendacious technology and Shadow Bank crookery has ensured that there hasn’t been a free and open financial marketplace anywhere in the Western world for years. In some ways naive about the machinations of global monopolism and élite greed, still-industrial China has been wrong-footed by them time and time again. As long as things were going well in China (and Russia) this might not have been a serious problem. But now the Ukraine tension and subsequent anti-Putin oil measures alongside Japanese QE failure mean that it isn’t just economies and banking systems that are at risk: sovereigns are too.

Looking towards the eurozone, we can see political extremes in Greece, anti-euro riots in Italy, regional nationalism in Spain, and very serious fiscal and banking problems in France. In the US stock markets, there have been record-breaking Dollar flights in recent weeks.

One relatively stabilising day in the markets (Friday) is meaningless: a Developed world banking scam vs Emerging world economic expectations cock fight is coming. The two birds have maneouvred themselves into what could easily become mutually assured destruction. For the crowd betting around the pit, chaos and deflation are the only certainties.

Last night at The Slog: Massive deflation in the value of liberal democracy