The gentle art of productivity motivation

The gentle art of productivity motivation

GLOBALISTS PUZZLED: “We’ve cut labour costs but productivity is falling. Why?”

Here comes another of those realities that keeps ‘surprising’ those who hold the works of Friedman in high esteem: productivity in areas of static or negative blue collar income growth is falling.

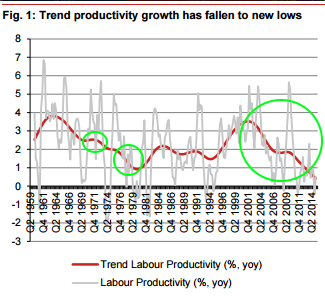

This is a chart of the state of affairs in the home of Devil take the Hindmost, the US of A:

There are two measures of productivity here – short term changes and long term trends. I’ve marked 3 key periods in green to make the point.

There are two measures of productivity here – short term changes and long term trends. I’ve marked 3 key periods in green to make the point.

Period 1 marks the accession of hardline neolib fiat currency fan Richard Nixon. The long term trend of falling productivity continues, but there’s a spike downwards.

Period 2 is the first term of Reagan, the first US President owned lock stock and barrel by Big Business. He gets elected and there’s a sharp spike down in productivity. And the long-term trend continues.

Period 3 covers the period when the Bushes became a business dynasty, and Uncle Tom Obama sold out to the globalist banking hegemony within 15 seconds of being elected. After a big spike of enthusiasm for a black Democract President, the longest productivity fall in US history follows – and still continues.

Since 2000, as the corporacratic takeover of the States has tightened its grip on liberal democracy’s neck, real (adjusted for inflation) median income has been static or falling. At the dawn of the new century, it stood at was $57k, but by last year, median income was $53k. Blue collar figures are the worst, but the living standards of US labour have been falling at a 0.5% annual rate ever since the turn of the century. It represents the worst 15-year period since records began.

The US business media refer to falling productivity variously as a mystery, a conundrum, a puzzle and a surprise.

The western nation next most in love with neolibollocks is the UK. Over the last thirty years we have seen labour force deregulation, tougher laws against strikes (with another one up Theresa May’s spout) declining trade union power, fewer and fewer employment term contracts, and the rise and rise of zero-hours contracts – better termed Job Seeker’s Ebay in Reverse.

Wages in the UK (especially blue collar) were hit hard by the 2008 liquidity crisis. By 2012, median household income had fallen to 2003 levels in real terms. Today, real wages levels are down 8% on 2009 figures.

Since the banking crisis of 2008 and the austerity mantra adopted by the Coalition soon afterwards, productivity rates in the UK economy have been falling. Today, they’re lower than they were in 2007. The Office for National Statistics (ONS) confirms that British labour productivity fell 0.2% in the last three months of 2014 alone. Q1 2015 shows a further 0.2% drop, such that David Cameron has presided over an economy with the weakest productivity record of any government since the second world war.

The Bank of England has a team fulltime looking at why productivity has fallen, calling it a puzzle. BoE Governor Mark Carney calls it ‘troubling’. The ONS calls it ‘unprecedented’, but offers no explanation. In classically insane Barclay twins style, the Daily Telegraph calls it ‘disgraceful’.

I should therefore like to intervene briefly into this further example of the blindingly Dayglo obvious being ignored by the Expert niche. It’s called falling morale, bitter resentment and reactive depression.

If you show workers zero loyalty, remove their negotiating rights and lower their wages, trust me – higher productivity will not be your reward.

I learned this lesson at my father’s ankles, aged about seven months.

This is The Slog Moral of the Day: You can be an expert with an IQ of 147, but still a blithering idiot.

It is yet more proof that the long-term neoliberal plan isn’t working.

Yesterday at The Slog: Amazing shock discovery that people with less money consume less.