“Who do you think you are kidding Mr Draghi/if you think contagion’s gone”

“Who do you think you are kidding Mr Draghi/if you think contagion’s gone”

With three days to go before an ‘important’ Greec/eurogroupe meeting – and four days to go before British election voting booths close – the Bank for International Settlements has handed both Syriza and UKip a tactical nuke…if they’re willing to use it.

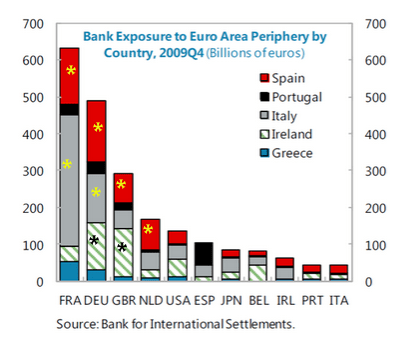

There was a knockout (in every sense of the word) chart on Twitter Sunday evening from @Edward_hugh which puts into sharp focus the Trojan efforts made by EU members to ensure they have nothing to fear from Greek default contagion. And yes, I have my foot to the floor on the iron pedal here. For your greater astonishment, I have added yellow and black asterisks to show some of the more horrifying exposures. Put together, they look like a flashers’ convention:

Just get those French and German exposures to Spain and Italy. Marvel at the German and British exposures to Ireland. And in relative size terms cf the economy, look at the Dutch exposure to all of them.

Just get those French and German exposures to Spain and Italy. Marvel at the German and British exposures to Ireland. And in relative size terms cf the economy, look at the Dutch exposure to all of them.

Then ask yourself why French, German and Dutch Troikanauts are keen to dissuade debtors from being inspired by Greece…exposure to which is minimal by comparison.

Ah-haaa. Then wonder at the fact that the Chairman of the eurozone central bank is an Italian. Then observe (sorry, the asterisks wouldn’t fit) what will happen to Spain when Portugal and Italy go down the pan.

But worst of all, eyeball that British exposure to Ireland, Spain and Italy in terms of potential bank balance sheet shredding. It adds up to €260bn. Then work out that the majority of that is sitting in the nationalised RBS crock of unplumbed sh*t. And then ask yourself what the Chancellor of the Day is going to do about a Government-owned bank which will be palpably unable to cope with a shock like that. No wonder Bank of England boss Mark Carney is building stress-test model upon stress-test model.

Now of course, Nigel Farage, Yanis Varoufakis and Alexis Tsipras are already well aware of this situation. With all three of them running out of time, it might be to their advantage to start pressing their advantage…up to and including having their goalkeepers in the opposition penalty area at corners. And if they don’t (given this isn’t a Friendly) we might be entitled to ask why.

Meanwhile, I will end here by starting the day on a more cheery note. A Chinese banker who lost $484,000 for a bank by pulling an embezzlement scam has been shot dead by firing squad.

Most read at The Slog in the last five days: Wolfgang Schäuble – German liar, US spy