A Brussels/Frankfurt EC document seen by Reuters proposes to use the savings of the European Union’s 500 million citizens to fund long-term investments, boost the economy, and help plug the increasingly large gap left by eurobanks since 2009.

A Brussels/Frankfurt EC document seen by Reuters proposes to use the savings of the European Union’s 500 million citizens to fund long-term investments, boost the economy, and help plug the increasingly large gap left by eurobanks since 2009.

The Slog exclusively revealed in April 2013 that Greek negotiators with the Troika had leaked the fact that the country’s lenders had tabled a pension/savings grab. Clearly, the idea hasn’t gone away…either in Athens or at the ECB. Three days later, these columns revealed wide awareness among the european markets and the euroélite of a massive outflow of investment funds from the eurozone area. At one point last year, Mario Draghi quietly suppressed capital flight data for four months.

Now the situation is desperate, and desperate measures are very much back on the table.

“The economic and financial crisis has impaired the ability of the financial sector to channel funds to the real economy, in particular long-term investment,” said the document, seen by Reuters. The European Commission will soonask the bloc’s insurance watchdog for advice on a possible draft law “to mobilize more personal pension savings for long-term financing”, the document said. After the May euroelections, naturally.

But the best bit of Orwellian doublespeak in the leaked file is this one: ‘the Commission will consider whether the use of fair value, or pricing assets at the going rate, in a new globally agreed accounting rule, is appropriate, in particular regarding long-term investing business models’.

Yes fellow citizens, reality and market valuations are no longer appropriate…we’re bust, so we need a new globally agreed accounting rule.

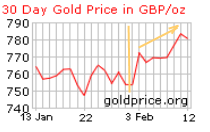

Like, for instance, the value of gold in central bank balance sheets? Look at the price of gold – £27 up in ten days:

Is this another Draghi/CEntral bankers’ directionalising exercise before the next revaluation of gold? Get the punters in, sell off, watch them panic, buy again at £650?

Is this another Draghi/CEntral bankers’ directionalising exercise before the next revaluation of gold? Get the punters in, sell off, watch them panic, buy again at £650?