….looks at gold-backed bonds to restore confidence

The Slog’s Brussels Mole reports that a bold double-whammy scheme to stabilise the euro and restore confidence in eurozone bonds ‘in the intermediate future’ is under serious consideration at the European Central Bank (ECB). The plan involves banning the private sale of gold in the proposed Fiskalunion, and using ECB gold supplies as collateral for sovereign debt bonds issued by member States.

In what will be seen as both sensational and horrifying by everyone from private investors to senior German financial figures, The Slog was today advised of the existence of an ECB plan to protect the single currency from desertion in favour of gold…and back some Fiskalunion eurobond and member State debt issuance with gold bullion.

It’s an odd mentality, is it not, that destroys confidence in eurozone bonds by cheating investors one year, and then looks to back the bonds with gold the next. It is, however, typical of ruthless eurofanatic tunnel vision to go for every last throw of the dice to before giving up.

That said, it is at least a creative idea – so we can be sure, therefore, that it didn’t originate in Brussels. The most likely original source of such a scheme is the front left cerebral lobe of Mario Draghi….or one of his chums in Goldman Sachs. Say for the sake of argument, Mario Monti.

“The idea is new Union, fresh start,” my source asserts, “The old fluffy eurozone is dead, long live the gilt-edged FU. They’re not going to do it next week, but there is an ECB task-force working seriously on the ramifications and details”.

Two days ago in Berlin, ECB boss Draghi made a significant comment when asked about the inflationary pressures of QE in the eurozone. I quote:

“in our assessment, the greater risk to price stability is currently falling prices in some euro-area countries.”

This was a calculated comment by Mario, designed to suggest a future where gold would represent a poor investment. Its effect was immediate: gold futures fell to $1703, and the hint was duly trotted out by several commentators.

“Gold is not getting any support since people are not talking about an inflation spike,” said Frank McGhee, the head dealer at Integrated Brokerage Services LLC in Chicago.

My view is more anthropological I’m afraid: Mario Draghi wouldn’t be indirectly rubbishing gold if he didn’t fear it.

In fact, The Slog’s bottom-line belief about gold hasn’t changed since 2009: with the exception of top-top end A+++ property, it is the best investment on offer given the current outlook. And although timing one’s purchase entry exactly right is as much about good fortune as calculation, by 2014, $50 this way or that could very easily feel like peanuts compared to the gains made.

Those who see gold as purely an inflation hedge are missing the point. Top end property and gold are must-buys for the big investors right now, because they want safety and survival once the global financial system starts unravelling in the face of eurozone debt contagion.

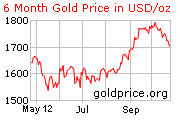

Look at what Soros and Paulson did in August. Both liquidated a huge tranche of stock investments in favour of an enormous call on gold. This is a six-month track of the gold price from May 12 this year:

You can see that by the time Soros and Paulson bought the shiny stuff, it’d been holding at between 1550 and 1600 dollars for three months. This was a rigorous test of the low, and it had failed. All you’d need to do then is read a couple of newspapers about QE, the eurozone disaster, and the global slowdown, and decide it would be daft not to buy.

The other consideration (when dealing with the likes of Paulson and Soros) is whether they know of the Draghi scheme already….and plan to (a) get in while they can, and (b) benefit from what would probably result: a rising dollar price of gold. Odder things have transpired on the Goldman Sachs bush telegraph.

Of course, when Big Dicks like these two buy big, it becomes a short-term self-fulfilling prophecy to some extent: after much hype, the price shot up to test $1800 by the end of September. But this is the lesson: the existence of such major opinion leader actions – and ironically, the current cyclical fall-back of gold making it look increasingly, temptingly cheap – would worry any organisation in charge of a dodgy currency. And as Draghi’s ECB is the proud owner of a Mickey Mouse euro, it is entirely logical that the all-or-nothing brigade would plan to close off the exit-route into gold.

It’s not as if there is no precedent in recent times: the Reserve Bank of India very seriously considered banning the sale of gold coins there during last June. And as of early September 2012, private citizens can no longer buy gold in Argentina. That’s not what the new law says, but it is the cast-iron practical effect of the legislation.

In fact, using gold to back bonds has been put forward before by the World Gold Council – they would, wouldn’t they? – but I can imagine the idea terrifying the US Treasury and Reserve. It could well, for instance, trigger an investor desire to inspect the contents of Fort Knox; and it would turn the QE thing into a whole different ball of wax.

Meanwhile, the question is there for European private gold-bug investors to address: should they get in while the window’s still open? More on this later at The Slog.

Update at 11.15 am BST Friday: Germany starts repatriating gold – Coincidence or coordination?